On Aug. 5, voters decided on a library levy lid lift – a funding measure that shapes future open hours and services at Whatcom County Library System.

UPDATE: Thank you, Whatcom County voters! We are pleased to share the news that Proposition 2 was approved by a majority of voters and funding for the library services that our community depends upon is secure for the foreseeable future. We are grateful.

Read the full statement, see what’s next and learn how to stay connected on the news section of our website.

ABOUT PROPOSITION 2025-02

Whatcom County Library System (WCLS) is asking voters to consider a measure (Proposition 2025-02) on the Aug. 5, 2025, ballot to restore the property tax levy rate that funds operations and services of its 10 community libraries, the bookmobile and digital resources. The library system is asking now in response to increased costs and demand for services.

![]() The measure would restore the property tax levy rate that funds daily operations and maintenance of its libraries to $0.42 per $1,000 assessed value. *

The measure would restore the property tax levy rate that funds daily operations and maintenance of its libraries to $0.42 per $1,000 assessed value. *

![]() WCLS last asked voters to approve a levy lid lift in 2009. At that time, voters approved a rate of $0.44 per thousand dollars of assessed value. Since then, the 1% tax levy cap and rising assessed values have reduced the levy rate to $0.26 per thousand. This is insufficient to maintain services.

WCLS last asked voters to approve a levy lid lift in 2009. At that time, voters approved a rate of $0.44 per thousand dollars of assessed value. Since then, the 1% tax levy cap and rising assessed values have reduced the levy rate to $0.26 per thousand. This is insufficient to maintain services.

![]() The number of people we serve and operating costs have significantly increased, and the library system’s annual expenses now exceed annual revenues.

The number of people we serve and operating costs have significantly increased, and the library system’s annual expenses now exceed annual revenues.

![]() If the levy rate is not restored, the library will need to cut services and eliminate staff positions.

If the levy rate is not restored, the library will need to cut services and eliminate staff positions.

*In today’s market, a levy rate of $0.42 per thousand dollars of assessed value will provide sufficient funding to support current services and will sustain the system into the future. State law allows library systems to request up to $0.50 per thousand dollars of assessed value. WCLS is asking for what it needs, not the maximum allowed.

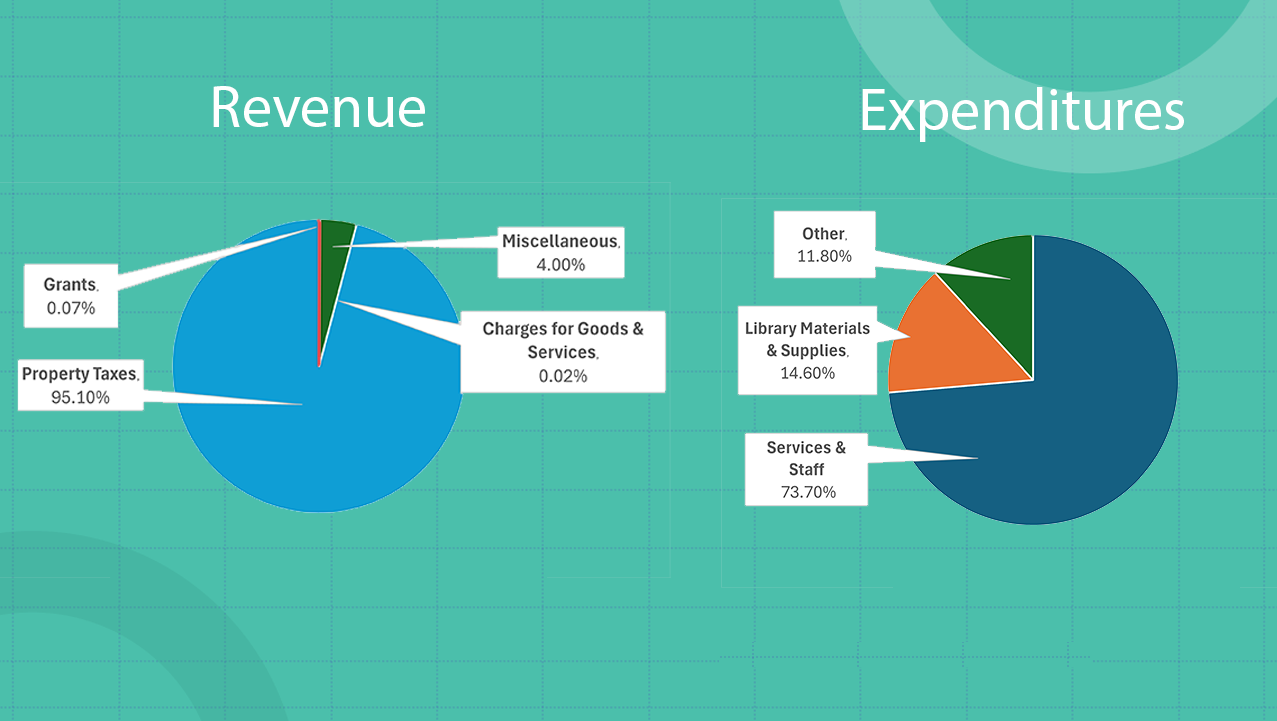

Local property taxes provide 95.1% of the library system’s operating budget. If approved by voters, this proposition would authorize WCLS to restore its property tax levy rate from its current level of 26 cents to 42 cents per thousand dollars of assessed value.

WCLS SERVES PEOPLE ACROSS WHATCOM COUNTY WHO LIVE OUTSIDE THE CITY LIMITS OF BELLINGHAM

- 10 library branches: Blaine, Deming, Everson, Ferndale, Lummi Island, Lynden, Kendall, Point Roberts, Sudden Valley, Sumas

- 4 Bookmobile stops: Glenhaven, Birch Bay, Wickersham, Lake Samish

- Library Express Locations: Northwest Drive, Birch Bay (under construction)

- Outreach services: schools, senior centers, homebound patrons, Whatcom County Jail, events

- Online 24/7 wcls.org

HOW WOULD THIS NEW LEVY RATE AFFECT MY PROPERTY TAXES?

| HOME VALUE* | CURRENT MONTHLY COST | PROPOSED INCREASE | NEW MONTHLY COST |

|---|---|---|---|

| $400,000 | $9 | $5 | $14 |

| $600,000 | $13 | $8 | $21 |

| $800,000 | $17 | $11 | $28 |

| HOME VALUE* | CURRENT YEARLY COST | PROPOSED INCREASE | NEW YEARLY COST |

|---|---|---|---|

| $400,000 | $104 | $64 | $168 |

| $600,000 | $156 | $96 | $252 |

| $800,000 | $208 | $128 | $336 |

*Exemptions are available for qualifying seniors, people retired due to disabilities and veterans with disabilities.

PROPERTY TAX CALCULATOR

Your Estimated Monthly Cost

Enter your property’s assessed value to see your estimated annual and monthly cost if the levy is restored at $0.42 per $1,000 of assessed value.

This reflects an estimate for the total monthly and annual cost a homeowner would pay in 2026.

Note: This tool provides an estimate only. Actual amounts may vary depending on your county’s final assessed property value, exemptions, or other local factors. For detailed information, , visit the Whatcom County Assessor website.

FREQUENTLY ASKED QUESTIONS

GENERAL QUESTIONS

FINANCIAL QUESTIONS

LEARN MORE ABOUT LEVIES

FOR MORE INFORMATION OR TO SCHEDULE A COMMUNITY PRESENTATION, EMAIL: WCLSLEVY@WCLS.ORG